From Clearance to Cash:

How to Cut 18 Months Off Your Reimbursement Timeline

Article by Blythe Karow

Table of Contents

- Introduction

- The Timeline Reality: Why 24-36 Months is Actually Optimistic

- Why the Process Takes so Long: The Bureaucratic Maze

- The Expectation Management Crisis: When Hope Meets Reality

- Market Access Timeline Pathways: Understanding Your Route to Revenue

- Proactive Planning & Execution is the Key to Successful Market Entry

- The Funding Reality

- The Bottom Line

- References

About the Author: Blythe Karow

"20+ years in health innovation. Former MedTech CEO turned strategic advisor. I help startups, VCs, and healthtech teams bring products to market faster and smarter."

Introduction

There’s an open secret in medical device product development that separates the veterans from the newcomers: FDA approval is the midpoint, not the finish line. Experienced MedTech investors already model 24-36 months from clearance to meaningful revenue. Seasoned startup CEOs build this timeline into their funding strategy, reimbursement experts plan for it from day one, but often first-time MedTech entrepreneurs discover this the hard way.

Market access strategist Kai Carter recently experienced this disconnect when she told a promising CEO it would take years to get his innovative device broadly covered by major payers and consistently reimbursed. He had just received FDA clearance after an 18-month clinical trial; in his mind the heavy lifting was done and revenue should start flowing within months. The look she received was as if she’d just swapped his morning espresso with lukewarm decaf.

Two and a half years later, his company received its first comprehensive coverage decision - exactly 30 months after they began the reimbursement process.

FDA approval creates one of the most dangerous illusions in MedTech innovation: that you’re market-ready when you’re really only halfway there. We see it a lot. Companies invest years and millions getting FDA clearance, then celebrate like they’ve crossed the finish line. Board meetings turn triumphant. Press releases go out. Investors start expecting hockey stick growth. The reality is that 56% of FDA-approved medical technologies still have no Medicare coverage at all.

The gap between a timeline born from optimism and one grounded in reality is where many innovations fail to make it onto the balance sheet. But here’s where you can adapt your strategy to use this knowledge to your advantage. Understanding this gap isn’t just about managing expectations. It’s about building competitive advantage through “Strategic Patience with Tactical Speed.”

The Device Files: From Concept to Commercialization is a reader-supported publication. To receive new posts and support Blythe's work, consider becoming a free or paid subscriber. Upgrade to paid

The difference between companies that beat these averages and those that become cautionary tales isn’t luck - it’s strategic market access planning that begins long before FDA submission. The insights that follow reveal how market access professionals architect coverage pathways, build payer relationships, and position clinical evidence to land consistently on the favorable side of reimbursement timelines.

The Timeline Reality: Why 24-36 Months is Actually Optimistic

First a Quick Note on Averages

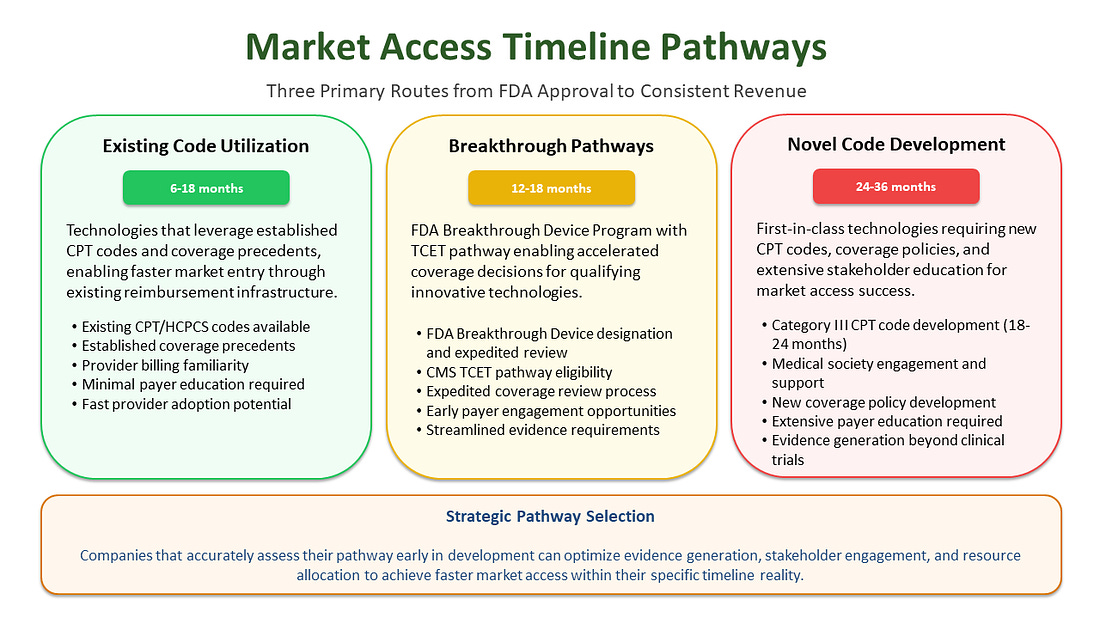

Industry data shows an average timeline of 24-36 months from FDA clearance to consistent reimbursement. But this average masks critical variations that can make or break your commercialization strategy. Many assume a product that has existing coding will easily get coverage within months or that a New-to-world device will land right on the average 5.7 years, but these are averages for a reason.

“Me-too” products - those leveraging existing procedure codes, coverage precedents, and established reimbursement pathways - might navigate the system in 6-18 months with strategic planning. These devices benefit from existing reimbursement infrastructure; they demonstrate substantial equivalence for regulatory purposes and align with established coverage policies, thereby avoiding the need to create entirely new payment categories. However, even with existing codes, adequate payment levels aren’t guaranteed. The existence of a billing code doesn’t ensure payers will provide sufficient reimbursement to support broad adoption.

New-to-world devices requiring new coverage pathways face a different reality entirely. Recent research examining 64 novel medical technologies found that they took an average of 5.7 years to achieve Medicare coverage and consistent reimbursement from FDA authorization, with some requiring even longer timelines.1 These innovative technologies must establish new procedure codes, demonstrate health economic value, and navigate coverage determinations without existing precedent to guide the process, a process that requires extensive evidence generation and stakeholder engagement.

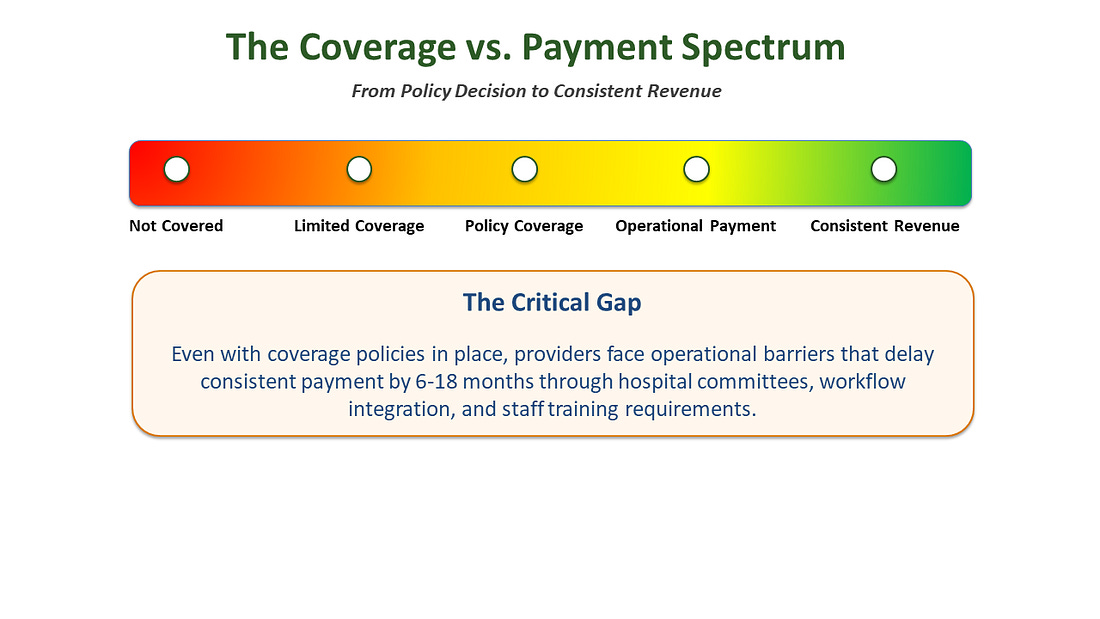

The Coverage vs. Payment Distinction

The confusion around timelines often stems from conflating “coverage” with “payment” - two fundamentally different concepts that create vastly different commercial realities.

Coverage means a payer has made a policy decision that a technology is “reasonable and necessary” and will be considered for reimbursement under specific clinical circumstances.

Payment means providers can actually bill for and receive money consistently when they use the technology with their patients.

This distinction is critical because many companies celebrate coverage decisions as revenue events, when in reality they’ve only achieved permission to begin the payment pursuit. The gap between coverage and consistent payment can extend 6-18 additional months as providers navigate hospital value analysis committee approvals, billing system updates and staff training, contract negotiations with Group Purchasing Organizations (GPOs), and prior authorization processes and workflow integration.

Why the Process Takes So Long: The Bureaucratic Maze

The extended timeline isn’t arbitrary; it reflects the inherent complexity of healthcare financing and regulatory oversight, which is designed to protect both patients and the healthcare system from unnecessary costs.

Regulatory Review Requirements

CMS operates under statutory timelines that prioritize thoroughness over speed. The NCD process generally takes nine to twelve months from formal acceptance of a request. In general, CMS must publish a proposed NCD within six months of posting the tracking sheet, with final decisions published within 60 days after the public comment period closes. However, if an NCD analysis includes an external technology assessment or Medicare Evidence Development and Coverage Advisory Committee (MEDCAC) meeting, the proposed NCD must be published within nine months rather than six.

Evidence Standards Mismatch

Data that medical device manufacturers submit to FDA to demonstrate safety and effectiveness may not always overlap with the data needed by payors to make coverage determinations. This creates a critical evidence gap that requires additional studies, real-world data collection, or coverage with evidence development requirements that can extend timelines significantly.

The Expectation Management Crisis: When Hope Meets Reality

Whose Expectations Are Being Missed?

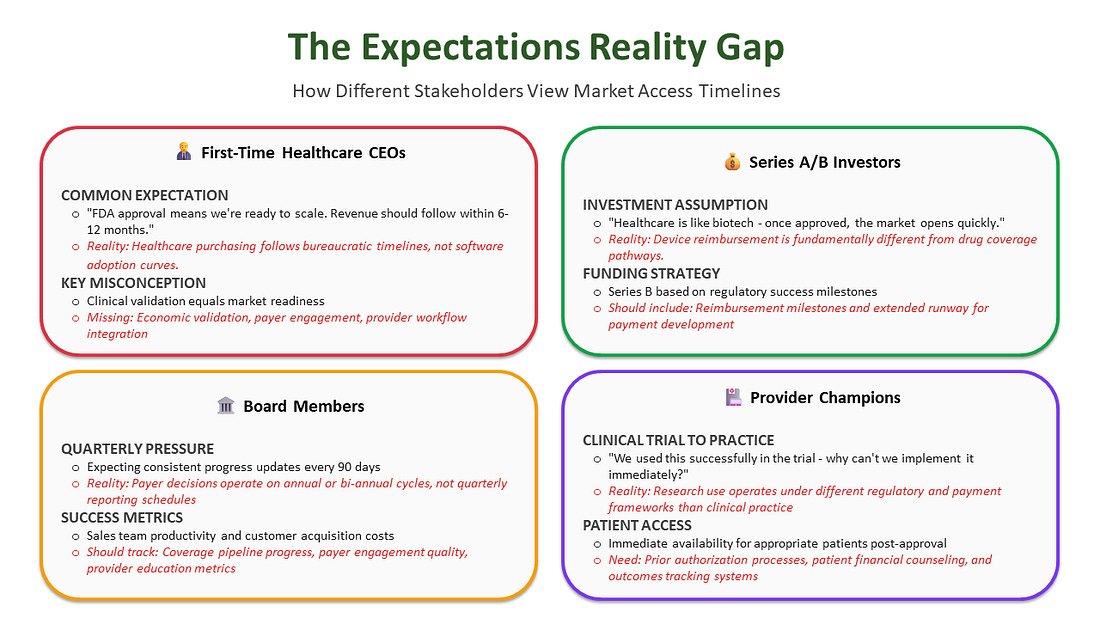

The timeline disconnect affects multiple stakeholders, each with different assumptions and tolerance levels:

Many First-Time MedTech CEOs and investors who haven’t “been there, done that” often model healthcare revenue like software adoption - expecting exponential growth curves once “the product works.” Medicare coverage follows bureaucratic timelines that don’t care about a Series B runway or quarterly board meetings.

The mismatch between quarterly investor reports and annual/bi-annual coverage determination timelines creates continuous tension.

When Should Realistic Expectations Be Set?

Pre-Series A (Ideally): Market access education should start during product development, guiding clinical trial design and evidence collection strategies. Companies should engage payors early using programs like FDA’s Early Payor Feedback Program or the TPLC Advisory Program (TAP) Pilot. These initiatives can help expedite patient access after FDA approval and support the faster development of safe and effective medical devices.4

During Clinical Trials: parallel pathway planning should start 18-24 months before the expected FDA approval. The Pre-approval Information Exchange (PIE) Act allows manufacturers to share specific clinical and economic data with payers before FDA approval or clearance, ideally 3-12 months in advance, providing a safe harbor from misbranding laws.5

Market Access Timeline Pathways: Understanding Your Route to Revenue

The path from FDA approval to consistent reimbursement follows distinct patterns based on technology type and regulatory strategy. Understanding these pathways enables more accurate timeline forecasting and strategic resource allocation.

Proactive Planning & Execution is the Key to Successful Market Entry

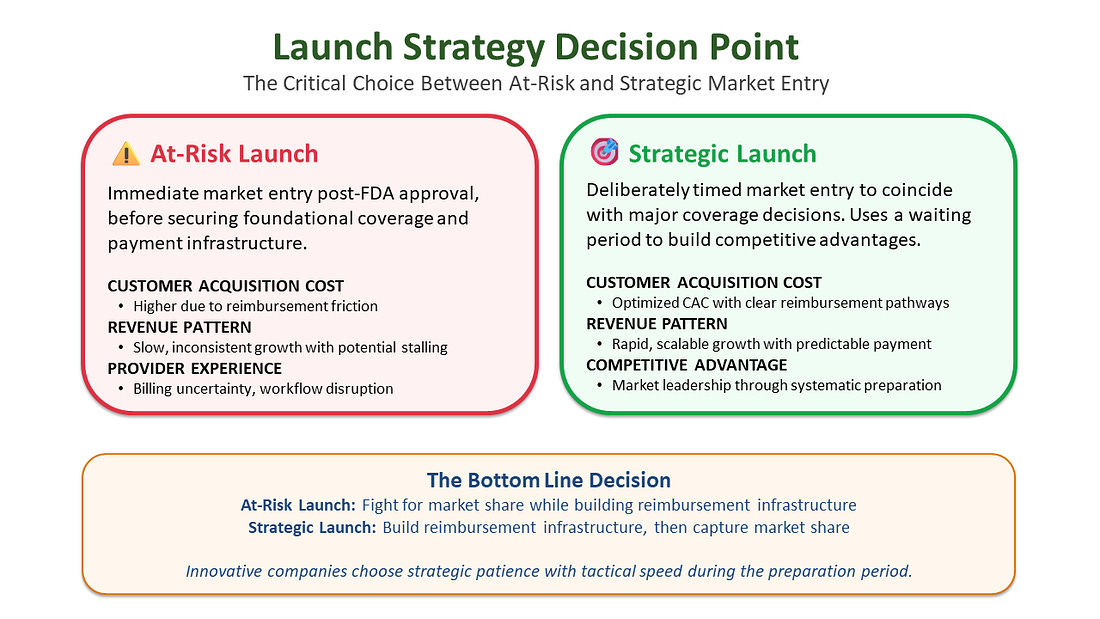

At-Risk vs. Strategic Launch

The moment a product receives FDA approval, the clock starts ticking on investor expectations. Board members want to see revenue, creating immense pressure for an immediate commercial launch. This creates a critical strategic choice between “at-risk launch” and “strategic launch.”

The Market Access Roadmap

Market access follows four critical phases that determine commercialization success.

- Phase 1 (Foundation Building) establishes the evidence infrastructure and stakeholder relationships through health economics research, medical society engagement, KOL network development, and payer advisory boards.

- Phase 2 (Code Strategy & Implementation) develops the billing mechanisms through CPT code applications and payer engagement, creating competitive moats that can protect market position for 3-5 years.

- Phase 3 (The Coverage Challenge) transforms coding infrastructure into actual payer commitments through NCDs, LCDs, and commercial payer medical policies.

- Phase 4 (Provider Adoption & Payment) converts coverage decisions into consistent revenue through hospital value analysis approvals, GPO contracting, EHR integration, and provider education.

These phases matter because timing determines competitive advantage. Companies that skip foundation building face delays and higher costs in later phases, while those that execute systematically achieve higher adoption rates, reduced customer acquisition costs, and more predictable revenue. Most critically, innovative companies begin Phase 1 activities 18-24 months before FDA approval, allowing parallel execution that can reduce time-to-meaningful-revenue by 12-18 months while building sustainable competitive advantages that competitors cannot quickly replicate.

The Market Access Playbook is a more in-depth, step-by-step guide for strategic leaders who want to optimize their reimbursement pathway, de-risk their market access, and beat the average time to full coverage and payments. But it will only be available to paid subscribers starting October 2, 2025.

Strategic Launch

Deliberately timing market entry to coincide with first major payer coverage decisions. This approach treats the coverage development period as preparation time rather than lost opportunity.

The most innovative companies use this period for aggressive, parallel-path execution to compress the timeline:

- Generate Demand-Side Evidence: Launch early adopter pilot programs with specified research protocols and IRB approvals 18-24 months before FDA approval, collaborating with influential Centers of Excellence

- Execute Publication Strategy: 6-12 months before FDA approval, ensure pivotal trial data and early real-world evidence (RWE) findings reach peer-reviewed journals to support payer conversations

- Prime the Payers: Execute compliant pre-approval information exchange under the PIE Act, sharing clinical and economic data 3-12 months before FDA approval

- Arm the Commercial Team: 3-6 months before commercial launch, deploy tiered training on the full economic value proposition

Centers of Excellence (COEs) are specialized institutions (typically academic medical centers or high-volume specialty practices) that can lead early pilot programs, generate credible evidence, influence payer coverage decisions, and speed up adoption.

Real-world evidence (RWE): Data collected from actual patient use outside clinical trials helps manufacturers, payers, and regulators understand how a product performs in everyday settings, supporting coverage decisions and demonstrating value to stakeholders.

This is how you turn waiting time into a strategic weapon, ensuring that on launch day, you’re not starting the race - you’re already positioned to win it.

Thanks for reading The Device Files: From Concept to Commercialization! This post is public so feel free to share it. Share

The Funding Reality

For CEOs managing investor relations, the reimbursement timeline isn’t just operational - it’s integral to funding strategy. Leading companies align their funding tranches with coverage achievements, not just regulatory milestones, recognizing that FDA approval alone does not guarantee market access or revenue generation. A misunderstood coverage delay can trigger dilutive financing rounds and signal to investors that management lacks market sophistication.

The most innovative companies make two strategic moves: First, they run market access in parallel with development - investing in payer evidence, health economics, and coverage pathway development before FDA approval. Sophisticated investors view this as risk mitigation, not “extra burn.” Second, they strategically time the commercial launch to coincide with major coverage decisions rather than rushing to market after approval.

The Bottom Line

The gap between FDA approval and sustainable revenue is where innovations either fail from lack of runway or build unassailable competitive positions. The complexity of healthcare reimbursement creates natural barriers to entry that favor preparation over speed.

Companies that accept the timeline reality and invest in systematic market preparation don’t just survive the reimbursement journey - they use it to leave their competitors behind. In an industry where being right too early can be as perilous as being wrong, strategic patience combined with tactical preparation represents the optimal approach for sustainable market leadership.

The 36-month speed bump isn’t a bug in the healthcare system - it’s a feature that rewards strategic thinking, evidence-based planning, and stakeholder relationship building. The companies that understand this don’t just navigate the system more effectively; they turn complexity into competitive advantage.

Thank you for reading! Find out all the ways you can support The Device Files here.

This article is the first in a series of reimbursement-focused articles written in collaboration with Kai Carter - a Market Access Expert with 20+ years of experience!

For MedTech leaders or investors looking for strategic guidance on corporate or product strategy and commercialization, let’s connect! The Karow Advisory Group

References

- Sexton ZA, Perl JR, Saul HR, et al. Time from Authorization by the US Food and Drug Administration to Medicare Coverage for Novel Technologies. JAMA Health Forum. 2023;4(8):e232260. doi:10.1001/jamahealthforum.2023.2260 [Note: This study examined 64 novel technologies requiring new Medicare coverage pathways. The study’s definition of “nominal coverage” includes both explicit coverage decisions and implicit coverage through billing codes, which may not reflect consistent payment experiences for most technologies.]

- Macary, Richard. “Fixing the reimbursement and coverage divide between ‘breakthrough’ drugs and medical devices.” STAT News, July 23, 2024. Available at: https://www.statnews.com/2024/07/23/fda-breakthrough-drugs-medical-devices-reimbursement-coverage-needs-fix/

- Centers for Medicare & Medicaid Services. “National Coverage Determination Process & Timeline.” CMS.gov. Available at: https://www.cms.gov/cms-guide-medical-technology-companies-and-other-interested-parties/coverage/national-coverage-determination-process-timeline

- U.S. Food and Drug Administration. “Medical Device Coverage Initiatives: Connecting with Payors via the Payor Communication Task Force.” FDA.gov. Available at: https://www.fda.gov/about-fda/cdrh-innovation/medical-device-coverage-initiatives-connecting-payors-payor-communication-task-force

- Avalere Health. “Pre-Approval Information Exchange Aids Manufacturer--Payer Engagement.” November 17, 2023. Available at: https://avalere.com/insights/pre-approval-information-exchange-aids-manufacturer-payer-engagement

- Centers for Medicare & Medicaid Services. “Final Notice --- Transitional Coverage for Emerging Technologies (CMS-3421-FN).” CMS.gov. Available at: https://www.cms.gov/newsroom/fact-sheets/final-notice-transitional-coverage-emerging-technologies-cms-3421-fn

- CPT® is a registered trademark of the American Medical Association. Copyright American Medical Association. 2025. All rights reserved

- American Medical Association. “2024 AMA prior authorization physician survey.” Available at: https://www.ama-assn.org/system/files/prior-authorization-survey.pdf

The Device Files: From Concept to Commercialization is a reader-supported publication. To receive new posts and support Blythe's work, consider becoming a free or paid subscriber.